This is a sample article from the May 2012 issue of EEnergy Informer.

Competitively supplied electricity is thriving, and will do better, given a choice

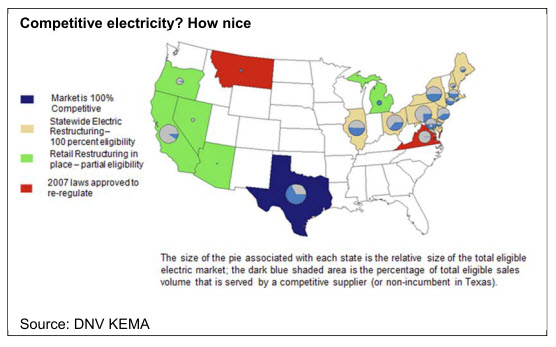

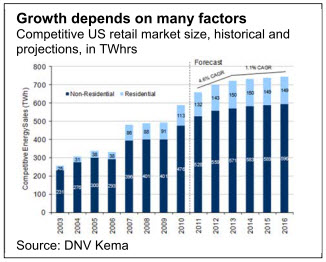

The recent recession has been hard on many businesses and industries, including the power sector. US electricity consumption in 2011 at 3,710 TWhrs was marginally below the 2008 level of 3,716. Yet despite the stagnant growth, electric load served competitively grew 40%, from 488 TWhrs to 685 over the same period, a rather remarkable feat.

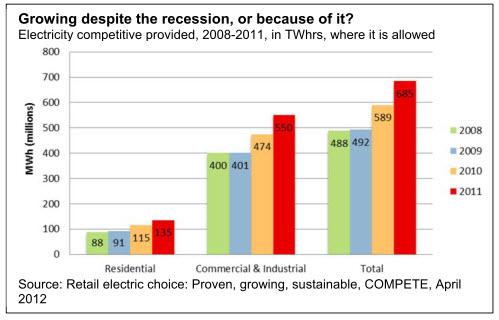

Competitively supplied electricity, which is currently available to customers in 18 jurisdictions, with a number of restrictions, accounting for 44% of US sales, amounts to 18% of the total US electric load. The number of customers supplied competitively grew 53%, from 8.7 million to 13.3 million since 2008, according to a recent report released by COMPETE, a pro retail choice organization.

Retail competition in electricity markets, a hot topic in late 1990s, was expected to sweep the country, and there were speculations that it would be federally mandated. But the collapse of the California’s dysfunctional market in 2000-2001, aggravated by opportunistic and manipulative traders, notably Enron, dashed such aspirations.

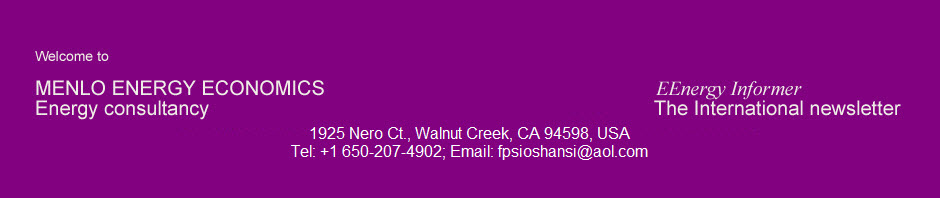

Only one state, Texas in 2002, has opened its electricity market since then. A number of states that were contemplating the move, abandoned plans to do so. As a result, only 18 jurisdictions — 17 states and the District of Columbia — currently offer customers the option to choose their electric supplier, with a few important caveats (see map above).

In California, customers who switched suppliers when the option was available have been allowed to remain with the alternative suppliers. That represents roughly 13% of the state’s load (see table below).

In Michigan, a 10% cap was placed in service areas of two large investor-owned utilities in 2008, who lobbied for it. Other restrictions — some onerous — exist in other states including Oregon and Montana, while there is growing interest in places such as Pennsylvania and Illinois. For anyone outside the US

who thinks this is confusing and convoluted, it is.

Among a handful of states where virtually 100% of the load is eligible to select its supplier, Texas stands out with the lion’s share of competitive sales at 221 TWhrs, roughly 32% of the total.

Not only does Texas have, by far, the biggest competitive retail market, it has the largest number of suppliers and is generally considered a model for other states who may be contemplating to open their markets.

What makes one state’s retail market successful — while other markets languish with customer and supplier apathy — is complex.

Young Kim, the Associate Director of Retail Markets at DNV-KEMA says, “It takes a strong combination of sensible market design, to incent retailers to enter and flourish, and regulatory support, to educate customers and promote choice.”

Looking ahead, Kim believes that retail choice will continue to grow, albeit at a pace allowed by politics of regulation on a state-by-state level. “There is the potential for substantial growth in several states — Arizona, Michigan, California, Ohio — that currently have legislative or economic caps on competitive retail choice,” adding, “The retail community in large part will determine whether these caps will be moved upwards or lifted entirely in the coming years. It will take a lot of cooperation and effort, but there is a strong momentum in the industry right now.”