This is a sample article from the May 2011 issue of EEnergy Informer.

Everybody knew it was going to cost a lot, and the latest estimate may prove conservative.

In 2004, the Electric Power Research Institute (EPRI), the collaborative research arm of the electric power industry, estimated that to implement the smart grid would cost around $165 billion for the US, give or take a little. That, many said, is a lot of money, and questioned if the benefits would outweigh the costs.

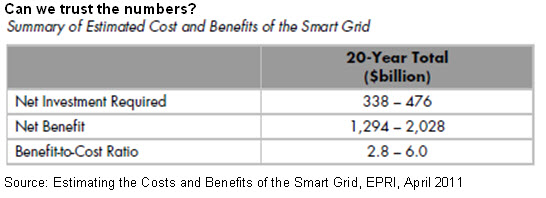

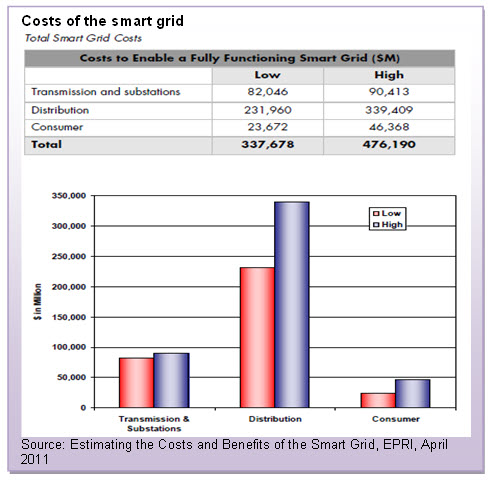

Fast forward to 2011 and an updated assessment, which puts the figure for a fully functioning smart grid for the US electric power sector somewhere in the range of $338-476 billion. If you think that is a lot, the US Interstate Highway System that began under President Eisenhower, cost roughly $500 billion if measured in today’s dollars. It was a lot of money, but by most measures, it was a real bargain.

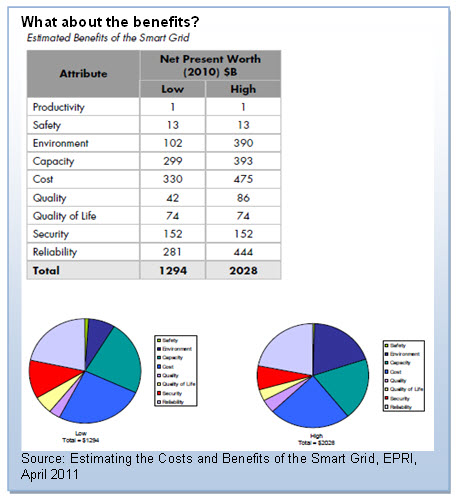

EPRI claims that the same will be true for the smart grid, but only better. It estimates the potential benefits of the smart grid somewhere around $1.3-2 trillion, again, give or take a little.

The purported benefits of smart grid would come from multiple sources, some more difficult to assess or put a value on, including the following:

- More reliable power delivery and quality, with fewer and shorter outages;

- Enhanced cyber security;

- A more efficient grid with reduced energy losses and a greater capacity to manage peak demand, lessening the need for new generation;

- Environmental and conservation benefits including enhanced capabilities to integrate renewable energy and electric vehicles (EVs); and

- Potentially lower costs for customers through greater pricing choices and improved access to energy information.

As useful and timely as it is, it must be pointed out that the EPRI report is a “high level” exercise with ballpark guesstimates of what the costs and benefits may turn out. While this is helpful, for many technical people working in the trenches, the numbers are fluffy and the estimated cost/benefits suspect. Moreover, EPRI takes a holistic perspective of smart grid from a national point of view. This may be helpful for a policy maker but not necessarily to someone trying to justify the cost-effectiveness of a particular smart grid, smart metering or dynamic pricing scheme.

But as is often the case, one must start somewhere, and this is as a good place to start as any. A study by IEA, The Technology Roadmap: Smart Grids. provides another assessment of the benefits of the smart grid at an even higher level of abstraction.

Explaining the increased price tag, Mark McGranaghan, EPRI’s VP of Power Delivery and Utilization says, “This cost assessment factors in new technologies and customer benefits that create a more resilient, self-healing and interactive grid that were not available when the 2004 analysis was completed.”

EPRI considered projected costs over the next 20 years in four key areas, transmission, substation, distribution and customer interface. Broadly, the costs fall into two categories:

- Investment required to meet load growth and to address existing deficiencies — such as power flow bottlenecks and high-fault currents that damage critical equipment — through equipment installation, upgrades and replacement; and

- Investment needed to develop and deploy advanced technologies to achieve “smart” functionality of power delivery systems.

As is usually the case, it is harder to put a value on the benefits than the costs, but that does not prevent people from trying (again see the IEA report).

The reality on the ground, however, is rather different, at least as reported in a recent survey conducted by Microsoft Corp. and presented at the CERA Week Conference in Houston in mid-March 2011. According to a poll of 210 utility executives and smart grid experts from around the world, only 8% have passed from planning into implementation phase — which means that 92% are simply fiddling around — our words, not theirs.

Why hesitate when the benefits of the smart grid are so overwhelming, according to EPRI’s assessment? The main barriers often mentioned include uncertainties on financial, regulatory, technology and return on investment of smart grid initiatives — that covers the entire utility business spectrum, does it not?

Microsoft’s managing director for Worldwide Power & Utilities Industry, Jon Arnold, tried his best to put a positive spin on all this when he said, “Our study clearly indicates the hype cycle is over, and more utilities today are planning smart grid implementations.” But 64% of Microsoft’s survey respondents said they did not have a clear view of the enterprise-wide information and technology infrastructure they will use to structure current and future smart grid deployments.

Undaunted, Mr. Arnold explained, “We’re seeing a normal phenomenon occur in terms of the evolution of thinking about these projects. Utilities are finding out what they don’t know, and they are, naturally, exerting some caution before making big investments, even though the willingness to spend is there.”

This newsletter’s reading of the Microsoft’s own survey, and few others, leads us to different conclusions. There is a lot more that the industry does not know about how, what, when, where, and how much of the smart grid puzzle. And companies who have embarked on large-scale implementation projects are, by and large, finding it tough going.

Business school gospel says there are clear advantages to be the first mover in any business, but many in the industry are waiting to see what happens to those who jump in the fire first. This explains why so many utilities are engaged in smart grid pilot projects. It is a much safer bet. One cannot be accused of inaction or indecisiveness, while keeping the financial and technical risk exposure to a tolerable level.