This is a sample article from the March 2010 issue of EEnergy Informer.

The DR potential is technically large yet elusive

The Energy Independence and Security Act passed in 2007 tasked the Federal Energy Regulatory Commission (FERC) to conduct a national assessment of demand response (DR) potential and report to Congress on:

- An estimate of the national DR potential in 5-10 years;

- How much of the potential could be achieved;

- Identify barriers to their achievement; and

- Provide recommendations to overcome the barriers.

In June 2009, FERC released a major study that provides the most comprehensive assessment of DR’s technical potential to date, and the results are nothing short of stunning. DR, of course, refers to any scheme designed to encourage peak load reduction or load shifting away from peak demand periods — whether achieved through direct load control (DLC), such as air conditioner cycling programs, interruptible tariffs, which allows a utility to cut off service during peak periods based on prior agreements, or more sophisticated pricing schemes which offer financial incentives to consumers to reduce discretionary usage during critical hours.

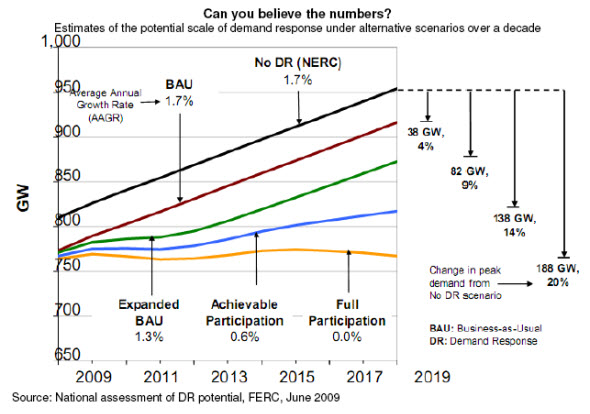

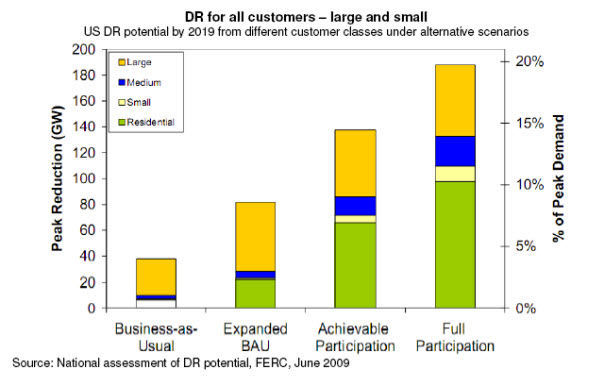

In the absence of DR, US peak demand — an artificial construct since US peak demand occurs at different times on different parts of the vast network — is projected to grow to 950 GW by 2019. The FERC study concludes that this can be reduced by as much as 188 GW — roughly 20% — under the most aggressive scenario. More moderate — and realistic — scenarios produce smaller but still significant reductions in peak demand.

FERC report is quick to point out that these are estimates of the potential, not projections of what could actually be achieved — a big distinction. The same distinction is often made in the case of energy efficiency studies where what may be technically possible is typically many times larger than what is deemed to be economically feasible defined as being cost-justified — and even this is usually far larger than what can be practically achieved given commercial market realities, discount rates and other so-called market barriers.

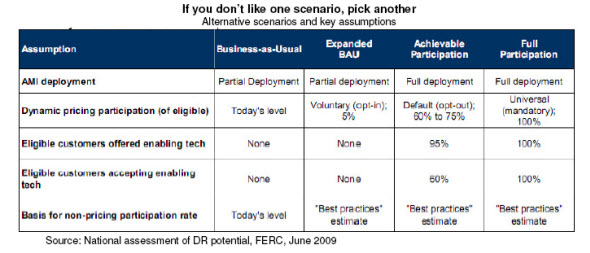

As for the scenarios selected for the study, the base case assumes virtually no DR, in which case peak demand will grow by roughly 1.7% per annum, on the average, through 2019. This is essentially what is assumed under the North American Electric Reliability Corporation (NERC) projections. Four successively more aggressive variations of DR potential are examined, each with a set of key assumptions that virtually produce the study’s results.

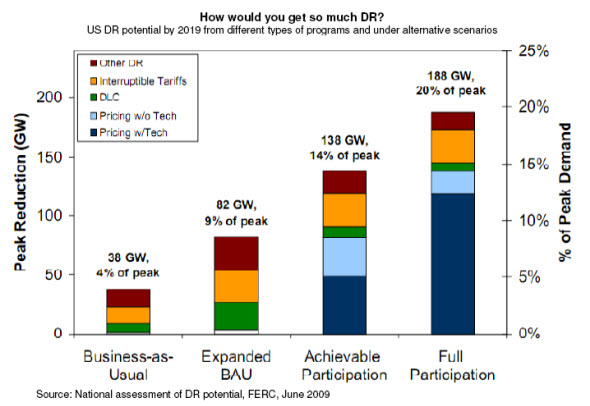

Where would so much DR be coming from? FERC report examines the main varieties of DR programs including interruptible tariffs, direct load control (DLC), a number of pricing schemes and other. Pricing schemes are further broken down to those with and without enabling/embedded technologies. The relative contribution of each is estimated in each scenario as shown in the accompanying graph.

The FERC study, which was managed by Brattle Group with input from other consulting firms, offers many insightful gems. For example, it points out that, “Today, the majority of DR comes from large commercial and industrial customers, primarily through interruptible tariffs and capacity and demand bidding programs. However, it is the residential class that represents most untapped potential for DR.”

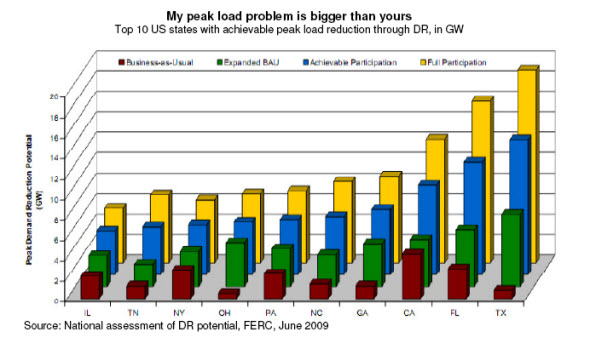

The states with the biggest absolute peak load reduction potential — surprise — are populous states with sharp summer peaks, mostly resulting from heavy air conditioning and lighting load in commercial and

residential sectors, with Texas, Florida and California in the lead. But in terms of potential of DR as percentage of peak load — another surprise — Connecticut, Maryland and Maine get the top honors.

The report will be submitted to the Congress in June 2010 following a period of public review and comment. In a prepared statement, Jon Wellinghoff, FERC’s Chairman said, “This study takes a flexible, real-world approach to gathering information on the potential for DR.”

The US Congress is not expected to do much with DR, or for that matter anything else, given its preoccupation with the approaching mid-term elections in November 2010. But FERC can be expected to push its DR agenda on organized markets including the independent system operators and other key players who are active in wholesale markets — which come under FERC’s jurisdiction.