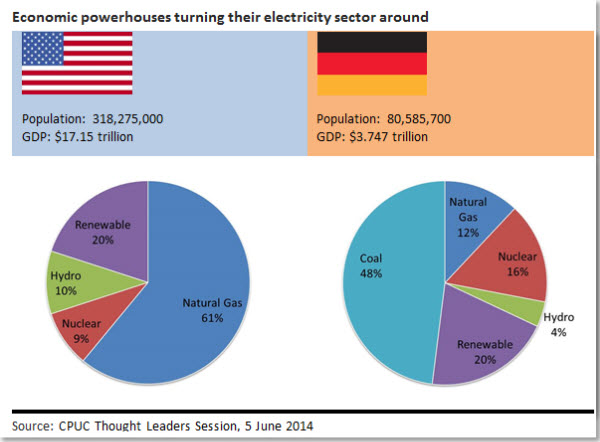

Which has done better, or worse, in their respective energy turnaround.

This is a sample article from the July 2014 issue of EEnergy Informer.

California and Germany may seem rather dissimilar in many respects. But when it comes to their ardent support of renewables, they are nearly identical. The motivations may be different, but the goals are similar. In the case of the former, the main driver is the state’s climate bill, passed in 2006, which requires state-level greenhouse gas (GHG) emissions to be reduced to 1990 levels by 2020 — don’t ask why, or how, or at what cost. This is driving a great many sub-goals and targets, including the state’s ambitious renewable portfolio standard (RPS), which requires 1/3rd of electricity generation to come from new renewables by 2020 — ditto on the why, and how and how much.

In the case of Germany, the energiwende (pronounced energhi-wende) or turnaround, is centered on a rash political decision made in haste in the immediate aftermath of the Fukushima nuclear disaster in Japan to shut down 8 perfectly safe operating reactors immediately and phase out the remaining 9 by 2022. Again, don’t ask why or anything else because you are not going to get any good, or even lame answers.

The hasty nuclear exist plus the country’s desire to reduce its carbon emissions by moving towards a growing portfolio of renewable resources explains the developments — and the associated problems and costs — in Germany.

At an event organized on 5 June 2014, California Public Utilities Commission (CPUC), which is among the main drivers of the changes taking place in the Golden State, invited 2 speakers representing 2 of the largest utilities in each country/state to exchange notes. The parallels and the challenges were strikingly similar.

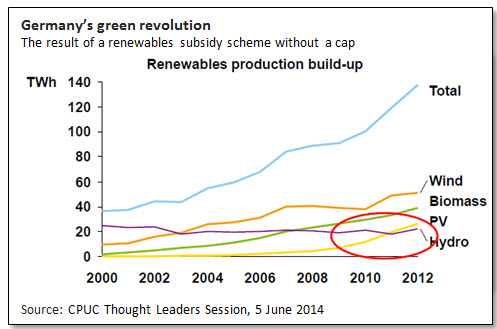

Graham Weale, RWE’s chief economist, Germany’s second biggest utility after E.ON, described the dramatic rise of renewables since 2000, especially from solar PVs since 2010 (graph above), and their impact on depressing wholesale prices while contributing to the rise in retail tariffs.

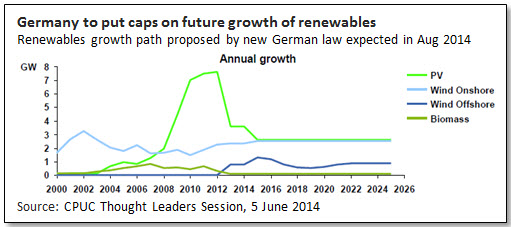

As reported in the June 2014 issue of this newsletter, German government has belatedly acknowledged, at least tacitly, that perhaps its energy turnaround has been too abrupt and possibly too expensive, certainly for residential and small commercial consumers who are bearing the brunt of the retail tariff increases. German politicians are particularly sensitive to the plight of the so-called export-sensitive industries, which are virtually shielded from all price increases associated with the rapid rise of renewables and their generous subsidies.

A proposal expected to become law in August 2014 is intended to put caps on how much additional renewables will be subsidized, while adjusting the subsidy levels downward, reflecting their falling costs

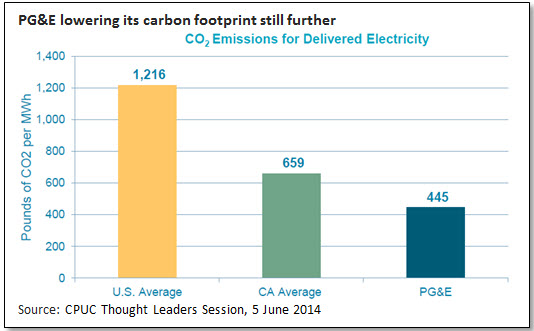

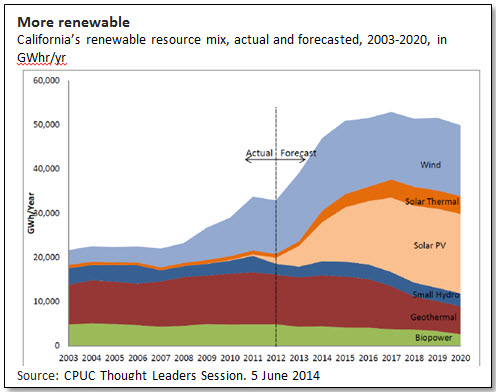

California’s experience with renewables was summarized by Fong Wan, Sr. VP of California’s largest investor-owned utility, Pacific Gas & Electric Company (PG&E) who, like RWE, must abide by edicts and targets coming from politicians and regulators. PG&E, among the greenest of major power generators in the US, is on target to further reduce its carbon footprint, already among the lowest of any major US utility (graph below right).

Not unlike Germany, with its 35 GW of installed solar PV capacity, PG&E is facing a rather steep rise from virtually nil in 2000 to over 1 GW, a trend that is expected to continue. Customer mounted solar PVs, incidentally, are not counted towards the 33% RPS target for 2020 since they are on the customer-side of the meter. They are treated as negative load by California Independent System Operator (CAISO), who can only guess their existence by watching the fluctuations in net load as the sun rises.

California renewable generation is expected to grow just as in Germany. Wan believes, as do many others, that California will in fact exceed the 33% target — partly because nobody — the utilities, the governor, or the regulators — can bear the negative publicity for failing to reach it.

Counting existing large hydro and old renewables that existed before the RPS standard was set, California’s generation mix can easily exceed 50% by 2020, making it among the highest among major global economies.

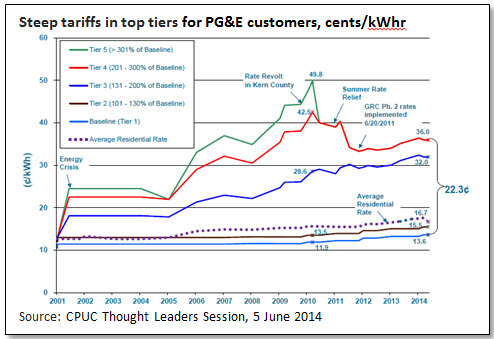

While German consumers are beginning to notice the rising retail tariffs, California’s high volume consumers have been exposed to some lofty tiered rates, but not because of the rise of renewables.

Since retail residential tariffs are tiered, consumers who get into top tiers pay steep prices. As illustrated in the graph below, PG&E’s top tier approached $0.5/kWhr in 2010, which resulted in consumer revolt in the hot central valley.

The top tier was subsequently eliminated, yet the 4th tier is now around 36 cents/kWhr, not exactly cheap. As described in the May 2014 issue of this newsletter, PG&E has proposed to move towards 3 and eventually 2 tiers over time — in an attempt to reduce the wide and widening disparity among the top and lowest tiers.

The top tiers have been rising because the bottom two were frozen after the 2000-01 electricity crisis. This resulted in all costs to be passed on to the top 4 tiers.

While both Germany and California could have done a better job of managing the transition to high renewable energy mix, on balance, it appears that the latter has done a better job — which is to say approaching its 33% new renewable target by 2020 while keeping retail rates reasonable.

California’s average retail electricity tariffs are around 17 cents/kWh, higher than the US average but a bargain compared to many high price European countries who have experienced steep retail tariff increases since 2008.

Moreover, according to a recent NREL/LBL study, high RPS targets appear to be achievable without putting undue pressure on retail tariffs