Opinions vary on how serious are the challenges facing the industry

This is a sample article from the November 2013 issue of EEnergy Informer.

For some time now, everybody and his brother, as the saying goes, is talking about the rapid changes taking place within the electric power sector and the potential impact of these on the future of the industry. This newsletter has had its own share of doom and gloom stories in recent issues. Are things really as bad as they are made out to be or will this hype, like the Y2K — remember? — will come to pass without much ado?

The regulators and policy makers in California are not so sure, but they have heard enough to get their attention. On 8 October 2013, the California Public Utilities Commission (CPUC) organized a session devoted to the business model for the electric utility of the future, inviting the head of the state’s policy making agency, the California Energy Commission (CEC) as well as the California Independent System Operator (CAISO) to participate. The heads of the state’s 4 major electric and gas utilities were also in attendance.

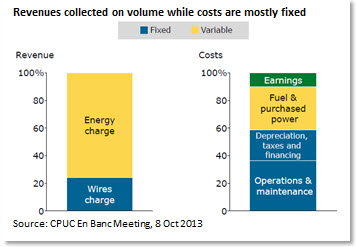

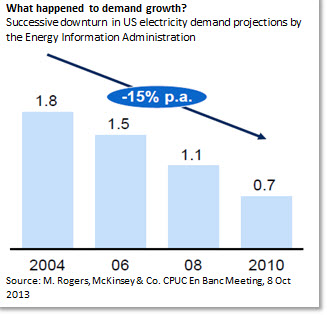

Several speakers described the challenges facing the incumbent industry players, who are, in California, still vertically-integrated and operate under rate of return regulations. The key problem, as everyone knows, is that the industry’s traditional revenue collection model, which is based on a fixed tariff applied to volumetric consumption, is showing signs of erosion due to customer self-generation at a time of tepid to non-existent demand growth.

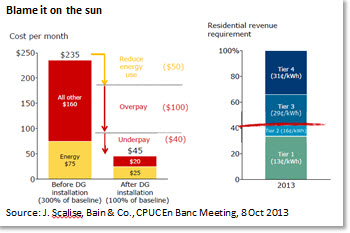

Solar rooftop PVs have become every utility’s nemesis, even though the erosion of revenues have been limited to date. But ever since the Edison Electric Institute published its report on the subject, net energy metering (NEM) and solar PVs have taken center stage.

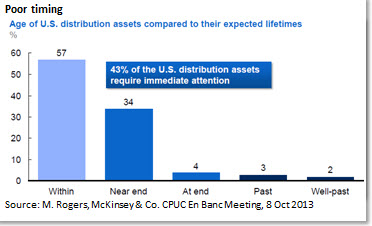

The challenge of distributed energy resources (DERs) could not have come at a worse time for the industry — just as massive investments are needed to upgrade and modernize an aging infrastructure (graph below), it is facing the prospects of a growing number of consumers buying fewer kWhs and paying even less for the privilege of being connected to the grid under prevailing laws.

One of the speakers, Jo Scalise of Bain & Co. presented 3 possible futures for the industry:

- (continued) Vertical integration;

- Decoupled monopoly; and

- (re-introduction of) Retail competition.

Each has its merits and perils. When questioned, Scalise said favored the last option, in which everyone can compete unencumbered to meet the needs of customers — with or without solar PVs.

The presidents of California’s large electric and gas utilities were given a chance to speak after the consultants had presented the various future scenarios. And at least to this observer, it seemed that they were rather attached to the status quo with all the protections, security and restrictions that comes with operating as a regulated monopoly. They were looking for direction and clarity from the regulators, not proposing any new or bold strategies to confront the challenges of a rapidly evolving business environment.

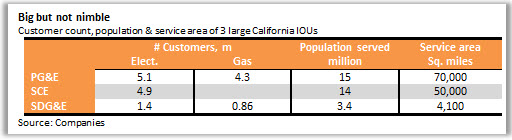

In fairness to the utilities, it must be said that at least in California, a giant regulated utility like Pacific Gas & Electric Company (PG&E) cannot do practically anything without first seeking the approval of the CPUC. And as several of the CEOs pointed out, the utilities felt that their hands were tied in what they could or could not do. In theory, their non-regulated affiliates could do pretty much as they please, but in practice, there are many restrictions on what an affiliate can do that it may not be worth the bother.

Michael Peevey, the President of CPUC, pointed out that US utilities lost countless billions in the 1990s buying assets and companies in competitive markets they did not fully understand. To think that they will do better this time around may take a leap of faith.

Mr. Peevey, however, did not seem overly perturbed by what he heard. He noted that compared to the initial introduction of retail competition in California in1998 when the IOUs collectively lost 13% of their sales over 18 months, rooftop solar PVs represent a mere nuisance. Not everyone agrees.

Nonetheless, the CPUC must be congratulated by thinking ahead just in case the minor nuisance turns into a gigantic revenue drain.