No longer niche players.

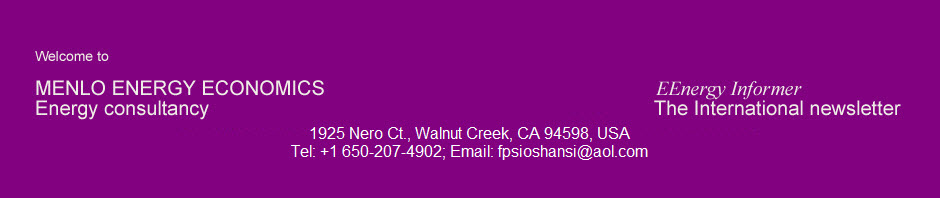

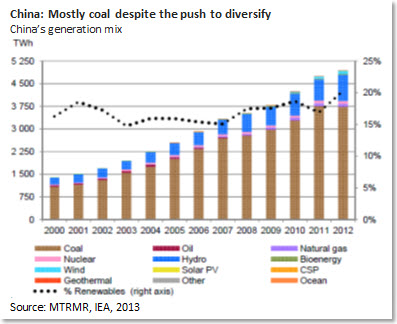

For those who continue to discount renewable energy resources as niche players, the International Energy Agency’s (IEA) latest Medium-term renewable energy market report (MTRMR) predicts that electricity generation from hydro, wind, solar and other renewable sources will exceed that of gas and be twice nuclear generation by 2016.

The MTRMR expects renewable generation to increase by 40% in the next 5 years. Renewables — currently the fastest-growing power generation sector — will make up almost a quarter of the global power mix by 2018, up from 20% in 2011. The share of non-hydro resources such as wind, solar, bioenergy and geothermal in total power generation is expected to double, reaching 8% by 2018, from 4% in 2011 and 2% in 2006. In absolute terms, global renewable generation in 2012 — at 4,860 TWh – exceeded China’s total electricity consumption.

Speaking at a recent Renewable Energy Finance Forum in New York, IEA’s Executive Director Maria van der Hoeven said, “As their costs continue to fall, renewable power sources are increasingly standing on their own merits versus new fossil-fuel generation,” adding, “This is good news for a global energy system that needs to become cleaner and more diversified, but it should not be an excuse for government complacency, especially among OECD countries.”

Trying not to offend the fossil fuel interests — IEA’s bread and butter — Ms. van der Hoeven pointed out that “worldwide subsidies for fossil fuels remain 6 times higher than economic incentives for renewables.”

Echoing what other renewable proponents say, IEA’s Executive Director cautioned against complacency. “Many renewables no longer require high economic incentives. But they do still need long-term policies that provide a predictable and reliable market and regulatory framework compatible with societal goals,” she said, referring to highly inefficient stop and go subsidies in Spain and the US (graph below).

With EU, the US and other regions facing stagnant economies and flat or falling electricity demand growth, the debate about the costs of renewable subsidies is heated. In addressing these issues, Ms. Van der Hoeven warned that, “Policy uncertainty is public enemy number one (for investors).”

The IEA’s bullish renewable outlook may be traced to 2 main factors:

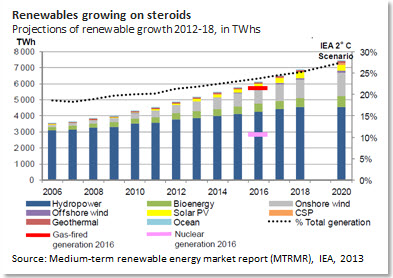

- First, is the rapid growth of investment and deployment in emerging markets — renewables are no longer limited to rich countries. Led by China, non-OECD countries are expected to account for 2/3rd of the global increase in renewable power generation between now and 2018.

- Second, is the fact that renewables are becoming cost-competitive in a number of circumstances.

The IEA claims that wind competes well with new fossil-fuel power plants in key markets such as Brazil, Turkey and New Zealand while solar energy is attractive in markets with high peak prices. As is widely recognized, the cost of decentralized solar photovoltaic generation can be lower than grid-provided retail electricity prices in a growing number of countries at prevailing tariffs.