The marginal cost is mere noise, or a loud thunder?

This is a sample article from the July 2013 issue of EEnergy Informer.

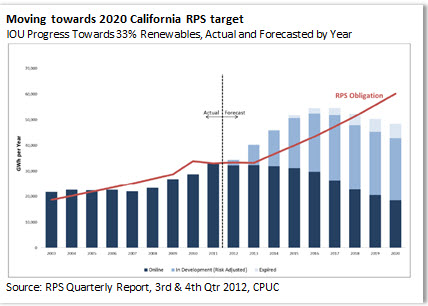

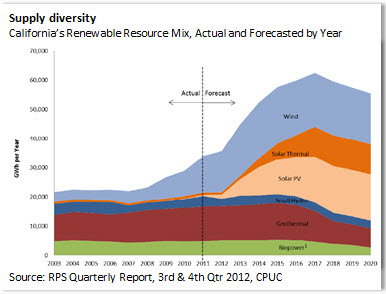

California, the most populous state in America, has the most ambitious renewable portfolio standard (RPS) — 33% of retail sales by 2020 have to come from new renewable resources, that is on top of existing hydro and other renewables. The critics of the RPS policy and California’s other stringent requirements, especially the state’s unilateral goal of reducing its overall greenhouse gas (GHG) emissions to 1990 level by 2020, claim that these policies will ruin the state’s economy, driving business and manufacturing away.

Renewable supporters point to the number of high paying jobs created — rather than destroyed — by the RPS mandates and see the state’s push for a greener, cleaner, leaner and more sustainable energy future as a potential model for other states and economies to follow. California, as everyone already knows, is not a cheap place to live or do business. The only way for California to thrive, they argue, is to push ahead in technological innovation and by moving further up the value chain. It will be futile for California to try to compete against its cheap labor, cheap energy, and cheap manufacturing rivals globally.

Such arguments aside, exactly how much does the RPS add to average electricity tariffs? An early 2012 report by the Division of Ratepayer Advocates, an independent entity within the California Public Utilities Commission (CPUC), estimated that the mandate would add $20.8 billion in power purchase contracts for new renewable generation by 2020 without saying what the likely rate impact may be.

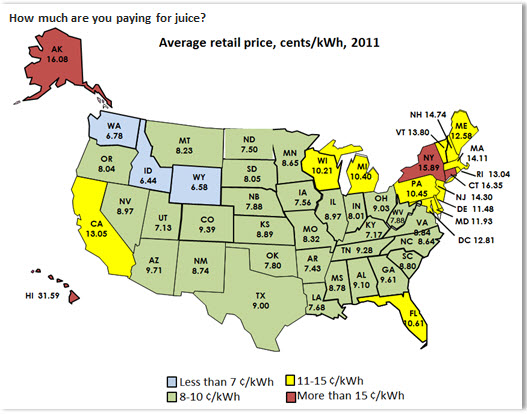

An article in Renewable Energy World reported an estimate by Anthony Earley, CEO of Pacific Gas & Electric Company (PG&E). He said that the first of these contracts now delivering renewable power to the grid will likely add only 1-1.5% to PG&E ratepayers’ household bills. Given that the average retail rates in California are relatively high by US standards, the impact on average monthly bills is expected to be low. Mr. Earley reckons the average California household, now paying $100 a month, would have to pay another dollar or so — a fairly negligible addition. He said it is the sort of variation in bills that is “really just noise.”

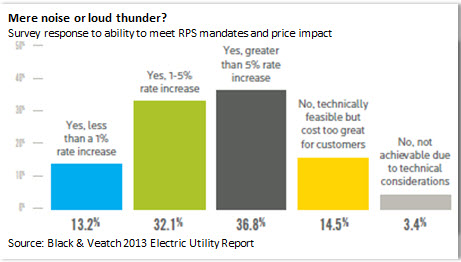

Noise or thunder, PG&E’s bill impact estimate comes as a surprise to other utilities in the US who expect renewables to add substantially more to retail prices. According to a survey of 607 industry participants conducted by Black & Veatch, nearly 70% expect the rate impact of mandatory RPS already in place to be anywhere between 1-5% or more than 5% (see graph below).

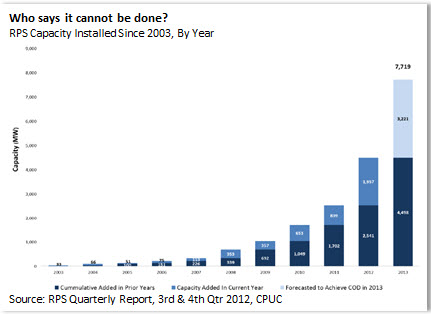

Even more surprising, nearly 18% of the respondents stated that meeting the RPS targets would cost too much to be feasible and/or casting doubt that the targets could be technically achievable. California has already passed the 20% mark and is expected not only to meet the 33% target by 2020, but perhaps exceed it.

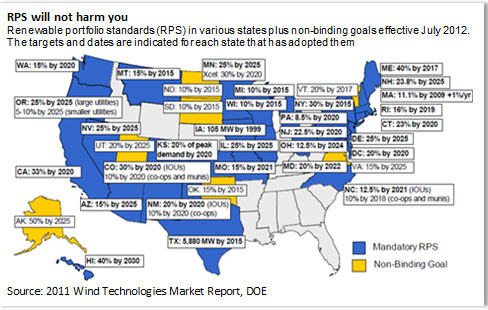

Not surprisingly, the most negative responses came from utilities in the Southeast, where coal-fired generation is dominant and there is little or no mandatory RPS to speak of (see map below). Perhaps the skeptics know something that California utilities have not discovered yet or — more likely — they haven’t had California’s experience in developing and integrating renewables into their network and simply don’t know what they are talking about. Only 13% of those surveyed by B&V said the cost impact would be 1% or less.

Referring to the CEO’s pronouncement in the Renewable Energy World, PG&E’s Denny Boyles concurred. “What Tony said is correct. We’ve forecast all along that adding the renewables to our portfolio would increase rates by 1 to 2% a year through 2020.” That would be a rather different story if it is 1 or 2% per year through 2020.

Among the 3 investor-owned utilities (IOUs), Southern California Edison (SCE) has had the most experience in negotiating renewable contracts, going back at least 30 years. According to Marc Ulrich, VP of Trading and Energy Operations at SCE, all 3 IOUs have executed long-term power purchase agreements (PPAs) for solar projects at prices below the Market Price Reference (MPR), which is the estimated cost of electricity from a 500-MW combined-cycle natural gas plant with assumption about the price of natural gas. MPR, a benchmark established by the CPUC, is used to gauge the cost-effectiveness of renewable contracts procured by utilities.

Talking to Renewable Energy World, Ulrich confirms that in a number of cases, contracts have come below MPR — suggesting they are cost-effective — but cautions that the methodology is based on “a spreadsheet model of somebody guessing (how much) natural gas … would cost” which is not necessarily what will actually happen.

Ulrich points out that comparing contracts for a natural gas plant with solar or wind plants is like comparing apples and oranges because the typical PPA for the former is for a few years, rarely more than 5 years, whereas for the latter, it typically extends 20 or 25 years. Moreover, contracts for renewables do not include a payment for fixed costs, as they do for gas plants. “The renewable PPAs we signed are 20 year contracts and they are almost all variable,” he said. In this case, utilities, and ultimately customers, pay only for the actual energy produced from renewable projects, not their fixed costs. And if the solar farm or the wind park does not generate, for whatever reason, they do not get paid at all.

Given President Obama’s recently announced restrictions on carbon emissions and lack of progress on nuclear, renewables and energy efficiency are left as the two primary ways to move forward. To the extent that more renewables increases retail tariffs, energy efficiency will gain further momentum. It is the least expensive way to go, and it is likely to be a better bargain.

The upshot? California’s RPS target, while ambitious and challenging, may not bankrupt the state after all, especially if one assumes that natural gas prices will not always remain as low as they have recently been.