This is a sample article from the June 2010 issue of EEnergy Informer.

Ideology gets in the way of comparing policy options while ignoring more fundamental global shifts

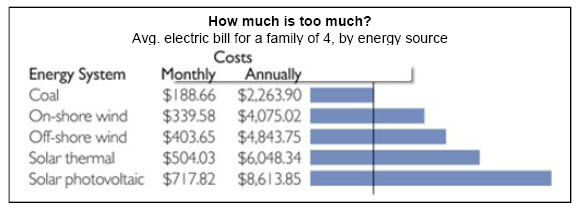

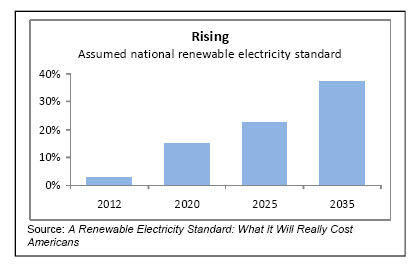

To promote renewable energy resources, many states have introduced mandatory renewable portfolio standards (RPS), and for some time, there has been talk of a national renewable electricity standard (RES). Not surprisingly, it would be legitimate to ask how much will we, as consumers and citizens, be paying for all this green and clean energy?

There are, of course, no shortages of answers — and depending on who you ask, the results vary by a wide margin based on the ideological inclination of the study’s sponsors, researchers and the intended audience. The American Wind Energy Association (AWEA), for example, would like you to believe that RES and subsidies for wind and other renewable resources are the best cure for all of the nation’s ills: notably unemployment, energy security, high costs of imported oil and climate. A right leaning think-tank like the American Enterprise Institute will convince you otherwise. The truth may be somewhere in between and — depending on the assumptions — can swing from one extreme to another.

A recent study by the Heritage Foundation (HF), a conservative think-tank titled A Renewable Electricity Standard: What It Will Really Cost Americans, concludes — not surprisingly — that “Instead of saving money for Americans, renewable energy sources are much more likely to spike their utility bills.” The study, which assumes a national RES starting at 3% in 2012 and gradually rising until it reaches 37.5% by 2035, claims that adopting such a policy “would be bad for families, bad for business, and bad for the economy.”

If you are looking for arguments against renewable energy resources, you need to look no further. According to the study, a federal RES will raise consumers’ utility bills, destroy jobs, add to budget deficits and result in little or no environmental benefits. The HF says RES will:

- Raise electricity prices by 36% for households, 60% for the industry;

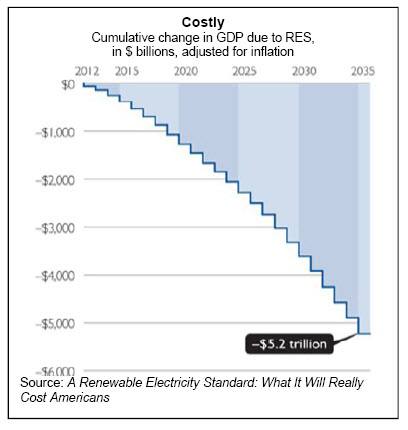

- Cut GDP by $5.2 trillion by 2035;

- Reduce national income by $2,400 per annum for a family of 4;

- Destroy 300,000 jobs by 2012 and 1.3 million by 2032; and

- Add $11,000 to an average family’s share of the national debt.

In short, nothing good will come of such a misguided notion. The intended message is “drill baby, drill,” the slogan favored by the extreme right wing of the Republican party. It is music to the ears of the coal, oil, gas and nuclear lobby — who often fund such studies.

Regardless of ones ideological orientation, the Heritage Foundation study points out that higher electricity prices will lead to lower consumption — presumably due to energy efficiency gains and loss of energy-intensive manufacturing. Residential consumers, facing a 36% price rise, are projected to reduce consumption by 19% relative to the baseline scenario for 2035 but will still face a $300 increase in average annual electricity bill. For industrial customers, the price rise may be as high as 60% resulting in 23% drop in consumption and 21% higher bills relative to the business-as-usual case.

Viewed from the vintage point of the HF, this is all bad. But one can make an argument for higher prices leading to higher energy utilization efficiencies and some adjustments in the composition of the economy, moving away from energy-intensive industries to higher value-added enterprises. This newsletter has nothing against manufacturing or heavy industry, but the reality is that such jobs are increasingly migrating to lower cost countries, with or without a federal RES.

The US manufacturing sector, which was operating at around 65% of capacity last June according to the Federal Reserve, has been gradually shedding jobs, a trend markedly accelerated during the current economic recession. And most economists do not expect any of the lost jobs to return even after the US economy rebounds. Studies such as this can put the blame on RES and those who are ideologically opposed to environmental causes (e.g., see related article on California’s climate bill) can predict doom and gloom, but the reality may be more fundamental structural shifts in the composition of the global economy.

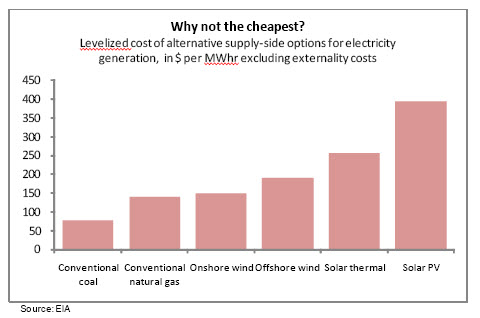

Few people would disagree with notion that renewable resources are currently more expensive than conventional fossil-fuels but many would argue that if we include the cost of externalities such as environmental and national security implications and take a long-term perspective — during which fossil fuel prices are likely to rise while renewable energy costs are likely to fall — the end justifies the means.