Nuclear fleets in the US, France & the UK aging with no renaissance in sight

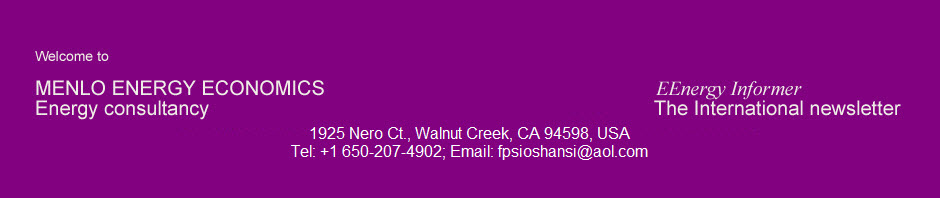

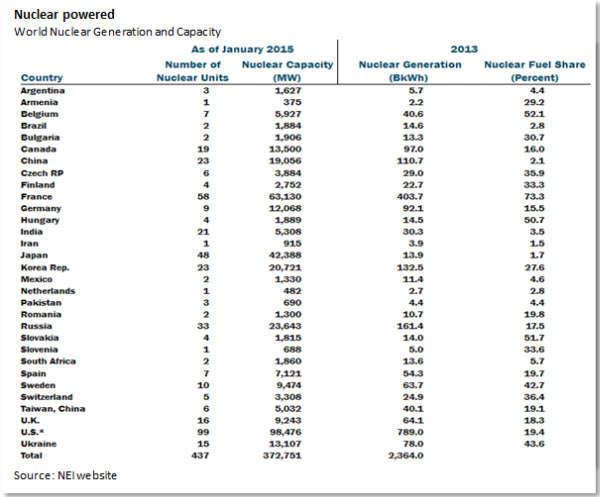

While Japan vacillates on the future of nuclear energy and Germany proceeds to phase out its nuclear reactors, the US, France and the UK are contemplating the fate of their own aging fleet against a backdrop of stagnant electricity demand and flat or falling wholesale prices due to the flood of renewable generation. Japan, once among the top 10 global nuclear generators, has fallen off the list since the Fukushima earthquake and tsunami in 2011 (graph below). Germany will also be off the chart by 2022 when the last one of its operating reactors will be shut down. The specifics vary from one country to the next, yet the prognosis is grim — and does not bode well for nuclear power outside centrally planned economies of China, India, Russia, South Korea and a handful of other countries still keen on atom.

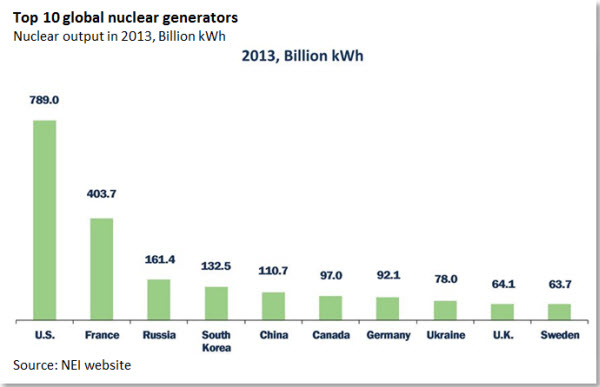

BP’s latest Energy Outlook 2035, for example, shows this reality in stark colors. Nuclear’s contribution to global energy demand has fallen from its peak (graph below on left) while nuclear generation in North America, Europe and outside China in Asia is also declining (graph below on right).

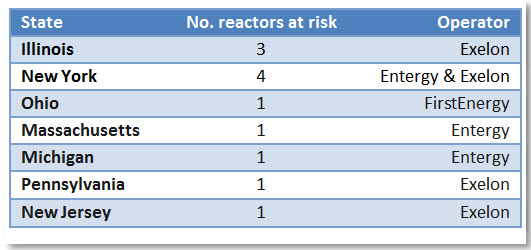

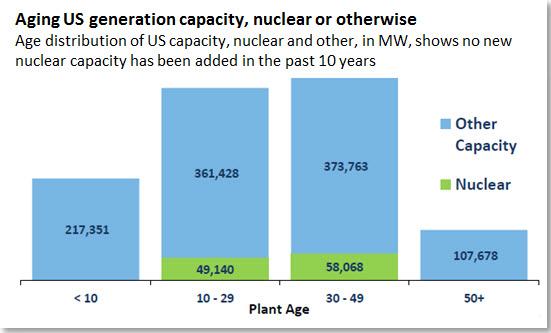

The situation in the US is approaching a critical state with ominous signs that an additional 10-15 reactors may be at risk of being shut-down prior to the end of their useful life for commercial reasons — they have a hard time earning enough in competitive wholesale markets to cover their operating costs — following several well-publicized recent closures.

The operators blame low wholesale prices, which in turn are blamed on dormant electricity demand and the growth of renewable generation — driven by mandatory renewable portfolio standards (RPS) — which flood the market with zero marginal cost electricity. Another reality, not always mentioned, is the fact that many of the reactors at risk are in need of major upgrades to meet higher safety standards following Japan’s Fukushima accident in 2011, which adds to the costs but not their profitability.

This explains the recent publicity campaign by the Nuclear Energy Institute (NEI), the US nuclear lobby, to persuade the Congress, the Federal Energy Regulatory Commission (FERC), the North American Electric Reliability Corp. (NERC) and wholesale market operators such as PJM to change market rules to keep the existing nuclear fleet in the black. The hoped for US nuclear renaissance has few believers.

Highlighting the impending crisis, Marvin Fertel the CEO of NEI claims that market flaws are putting even the most highly performing nuclear facilities at risk. He said, “It (makes) no economic sense to allow these (nuclear plants at risk) facilities to close because replacement electric generating capacity, when needed, would likely produce more costly electricity, more pollution and fewer jobs that would pay less” — all good reasons to make sure the existing nuclear fleet keeps operating.

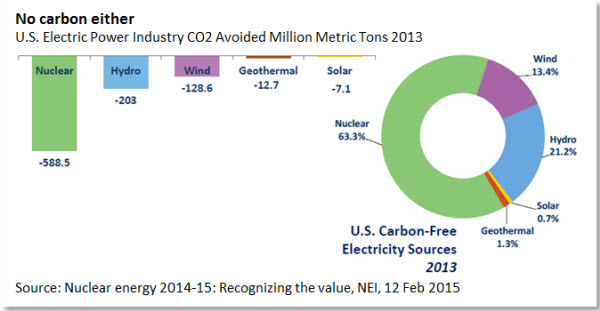

“Each source of electricity has its own set of attributes that provide varying degrees of value to the grid, and those attributes must be reflected in the total compensation provided to each generator,” according to Fertel. His point is that existing wholesale markets do not adequately compensate nuclear reactors for the reliable, baseload, low cost, non-carbon electricity they produce.

NEI has found a sympathetic audience at FERC and NERC, organizations responsible for overseeing efficient operation of wholesale markets and for maintaining grid reliability, respectively.

“We’ve seen significant movement in the past year on the part of FERC and the regional transmission organizations (RTOs) in recognizing the underlying problems in capacity market designs and prices in competitive energy markets,” according to Fertel, “… it’s imperative that concrete actions be taken that recognize the inherent value of nuclear assets in time to ensure that we don’t lose additional nuclear plants that are excellent performers.”

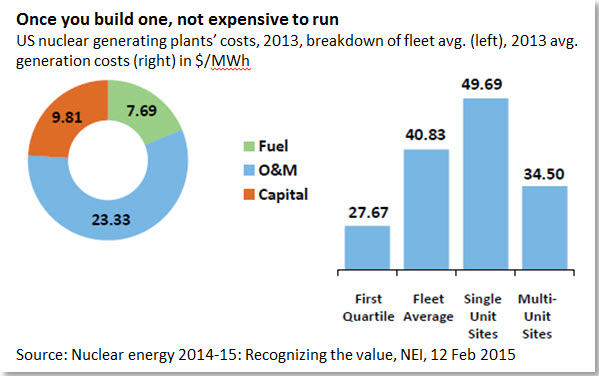

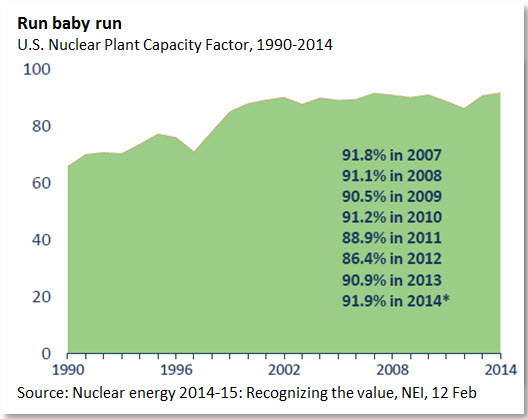

US nuclear plants have not only operated safely for some time but have an enviable performance record not matched by other thermal or renewable generators. According to preliminary estimates for 2014, US nuclear plants operated at an enviable average capacity factor of 91.9%. The corresponding number for wind parks are typically in the 20-30% range, somewhat higher for solar plants due to the intermittency of wind and solar resource.

To NEI’s delight, FERC appears receptive to explore possible changes to both capacity and energy market rules to give nuclear plants fair compensation for their flawless performance. In November 2014, for example, FERC ordered RTOs to generate “fuel assurance” reports — which favors nuclear plants and in December 2014, PJM, the biggest US wholesale market operator requested that FERC approve a new capacity performance product to enhance increased grid reliability.

NEI hired HIS, a consultancy, to prepare a report to support its claims for the value of energy diversity, and the risk that it could be lost should current market trends continue.

In France, the other major nuclear powerhouse, Electricite de France (EDF), the once proud operator of 58 operating reactors is facing a similar future: an aging fleet and no prospects for replacements. Only one new reactor is currently under construction in France — the European Pressurized Reactor (EPR) in Flamanville in Normandy — a project plagued with embarrassing construction delays and cost overruns.

Under President Francois Hollande, France is moving away from its over-reliance on nuclear power, currently providing roughly 75% of demand. An energy transition bill passed by the French National Assembly in October 2014 and expected to be ratified in 2015 aims to reduce it to 50% by 2025 — a move many French nuclear proponents view as absurd and counterproductive.

Making matters worse, the majority state-owned AREVA recently reported that it expects a loss of €4.9 billion ($5.6 billion) for 2014, partly as a result of its exposure at another trouble-plagued nuclear project — the Olkiluoto 3 EPR plant under construction in Finland. That plant is also hopelessly behind schedule and over-budget, a major embarrassment for AREVA and the EPR. AREVA is 87% government-owned, EDF 85%, so when they suffer, so does the government’s coffers.

Not surprisingly, AREVA, EDF, and Commissariat l’Energie Atomique et aux Energies Alternatives (CEA) have new bosses appointed by French Energy Minister Ségolène Royal.

In February 2015, EDF’s new CEO Jean-Bernard Levy, asked the government to allow electricity tariffs to gradually rise to pay for renewable energy projects while maintaining its aging nuclear fleet.

The situation is not much different in the UK, where an aging – antique may be a better description — nuclear fleet is rapidly approaching retirement with few prospects for a reversal — with the sole exception of controversial Hinkley Point plant, which was essentially given full assurance against commercial failure by the government. EDF has proposed to build and operate a new reactor at Hinkley Point given such assurances — unprecedented in nuclear power sector’s history in the West.

In the meantime, Japan remains in perpetual limbo with nuclear’s future getting tossed around while Germany is hastily marching towards a nuclear-free future in 2022. There is virtually no interest in nuclear build in Europe with several countries declaring that they will not replace their existing fleet once they are retired.

Nuclear’s future, to the extent that it has a future, is to be found in China, India, Russia, South Korea and a handful of newcomers aspiring to build new reactors.

Of the 71 nuclear reactors officially listed as “under construction” at the NEI website, 26 are in China, 10 in Russia, 6 in India and 5 in South Korea; that is 47 or 66% of the global total.

US, by contrast has 5, France 1; UK’s Hinkey Point is not listed yet as being under construction. Nuclear’s future in the West does not look good.

To download a printable (PDF) copy of this blog click here.

The contents of this blog may be reproduced, reprinted or distributed provided full attribution to EEnergy Informer Blog #2, 2 Mar 2015 is given. If you wish to be added to our mailing list for future stories, please send e-mail to eeinformer@aol.com with your name, affiliation & e-mail.