Solar vs. Non-solar Customers

The answer is outside the proverbial box

This is a sample article from the October 2014 issue of EEnergy Informer.

The power industry is undergoing significant change at an accelerated rate. This means that many of the concepts that traditionally made perfect sense, no longer do. Moving forward, many of the time-tested principles need to be examined in view of the changes, mostly but not entirely, taking place on the customer side of the meter.

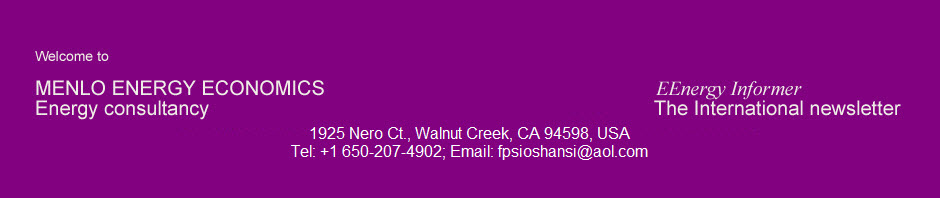

Perhaps the most significant of these developments taking the industry, and its regulators, by surprise is the rapid rise of customer self-generation, mostly through rooftop PVs, which are now near, at, or below grid parity in many high tariff jurisdictions (graph below).

US solar PV growth: Much more to follow

Source: Lighting the way, Environment America

Rooftop PVs make perfect economic sense if the prevailing tariffs are already high and/or rising. In Hawaii, where average retail residential tariffs are around 40 cents/kWh, for example, one does not need any subsidies or tax credits to invest in rooftop PVs, provided one has a roof and the means to invest in solar panels (article on Hawaii in October EEnergy Informer).

What makes solar self-generation even more attractive, of course, are generous feed-in-tariffs(FITs), prevalent in Europe and Australia, or net energy metering (NEM) laws, prevalent in many parts of the US.

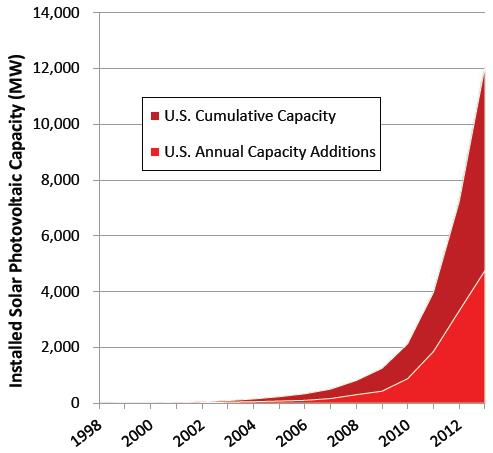

In places like California, where residential tariffs are tiered — that is they rise with higher consumption levels — the motivation to go solar becomes even more compelling for customers in top tiers. Every kWh generated on the roof means one less expensive kWh bought from the grid, currently 36 cents/kWh for Pacific Gas & Electric Company (PG&E) customers on the 4th tier. Under existing NEM law, all kWhs generated in excess of domestic consumption can be sold to the utility who must offer a credit equal to the prevailing tariff. That explains why roughly half of all US rooftop PVs are currently in California (graph below).

In a Sept 2014 brief titled Net energy metering: Subsidy issues & regulatory solutions, published by Institute for Electric Innovation (IEE), Robert Borlick and Lisa Wood examine the impact of California’s net energy metering laws on solar and non-solar customers, a highly charged topic.

US solar PVs: Half in California

Source: US Solar Market Insight Report, 2013 in review, Exec Summary, GMT Research & SEIA

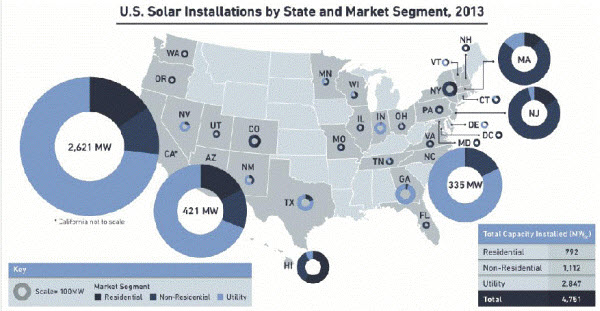

Focusing on customers of Southern California Edison Company (SCE) with tiered residential rates shown in table below, the authors conclude, among other things, that:

- As currently structured, California’s NEM subsidies are “overly generous,” more than the 30% federal solar investment tax credit (ITC) and more than is necessary to incent rooftop solar;

- Most of the subsidies go to affluent consumers, paid for by everyone else; and

- Since over 75% of solar rooftops in CA, and increasingly elsewhere, are leased these days, much of the NEM subsidy is siphoned off by the leasing companies — not as intended.

Residential tariffs are tiered in California, meaning higher rates at higher consumption

Source: Robert Borlick and Lisa Wood, Net energy metering: Subsidy issues & regulatory solutions, Institute for Electric Innovation, Sept 2014

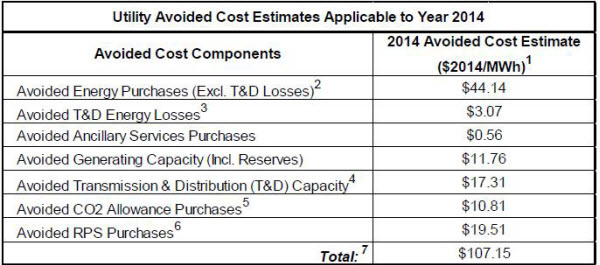

The utility, of course, avoids certain costs when customers self-generate. In the case of a vertically-integrated utility such as SCE operating under rate of return regulations, the avoided costs for a typical NEM customer are estimated in the table below. They include energy, capacity, transmission and distribution costs plus a number of other components as highlighted.

Accordingly, the utility saves roughly $107/MWh or 10.72 cents/kWh in the first year for kWhs not sold. Following the arithmetic, and examining two solar options, purchase vs. leasing, typical customer gains over $20,000 or $7,000 in net present value (NPV) over 25 years, respectively — lots of assumptions goes into the calculations — suggesting that both options are good investments.

In the former case, it represents a 17% after tax rate of return and a 7-year payback — not bad for a low risk investment. No wonder so many customers are going solar in California.

In the latter case, the leasing company receives the bulk of the NEM subsidies plus the federal investment tax credit (ITC), which explains why solar PV leasing companies such as SolarCity are making good money in states such as California. It also explains why the solar leasing lobby is strongly opposed to any changes in NEM laws, especially any increase in fixed monthly charges since this directly eats into their margins and sales pitch, which typically promises customers an estimated saving per month if they sign up for a long-term power purchase agreement (PPA).

There is a lot more in the IEE brief, but the authors’ main message is unequivocal. They write,

“The legitimate purpose of a subsidy is to provide an incentive to pursue a desirable public policy. Subsidies should not be overly generous; the amount of the subsidy should be transparent; and the recipient of the subsidy should be clearly identified. As our analysis demonstrates, the current NEM regulatory approach in California fails all these tests.”

The authors suggest replacing the current tiered rates with a single energy tariff combined with higher monthly customer charges. If tiered rates are to be retained, “they should not be available to DG (distributed generation) customers,” they say.

Avoided costs for customer self-generation

Source: Robert Borlick and Lisa Wood, Net energy metering: Subsidy issues & regulatory solutions, Institute for Electric Innovation, Sept 2014

This, of course, is not the first or only study looking at the costs and benefits of customer self-generation and — more important — who gains and who pays as some customers, affluent or not, go solar and avoid paying their fair share of the network’s substantial fixed costs. It certainly won’t be the last.

What the IEE analysis, and many others fail to capture, or capture adequately, is that they assume the virtual continuation of the status quo, where the distribution utility’s role remains static as the entity responsible for keeping the poles and wires intact and delivering electrons through copper wires to customers’ premises.

What such static analyses miss is the fact that — as California and New York regulators have belatedly discovered — the role and function of the distribution utility is dramatically and rapidly changing.

It is evolving from a one-way conduit to deliver electrons to a far more complicated and convoluted function of connecting various consumers, prosumers, self-generators, customers with EVs and other forms of storage, with home energy management systems and demand flexibility to large and small generators, both centralized and decentralized, thermal and renewable in a connected network that somehow allows all manner of transactions among any two consenting parties to take place.

In such a convoluted emerging environment, does it make sense to talk about a fixed monthly charge and a fixed cents/kWh tariff applied to volumetric consumption?

This editor believes that the regulators in both NY and CA have made a wise decision not to focus too narrowly on NEM subsidies or fixed vs. variable charges, but rather on asking what functions are to be performed — or enabled — by the distribution network of the future, where the distinctions between consumers vs. prosumers, central vs. decentralized, renewable vs. thermal are likely to blur over time.

The answer, it seems, is about who buys what from whom, when and where and under what terms and conditions — as further described in the following article. As the IEE brief explains, both fixed and variable charges may be out of line with today’s costs, and now may be the time to fix them. But focusing on current inadequacies of NEM laws in California may be akin to rearranging the chairs on Titanic’s deck.

Complex Transactions Made Simple With Transactive Energy

Incremental fixes will only go so far

Debating how to treat solar vs. non-solar customers is mostly focused on what are the costs and benefits associated with serving the former and whether they impose extra costs on the latter since they end up consuming fewer kWhs hence contributing less than fair share to the upkeep of the grid, on whose critical services they continue to rely.

If that were the full extent of the problem, an analysis such as the one summarized above — if you agree with the methodology and the assumptions — would suffice. But all indications are that that is not the full or even a partial extent of the problem.

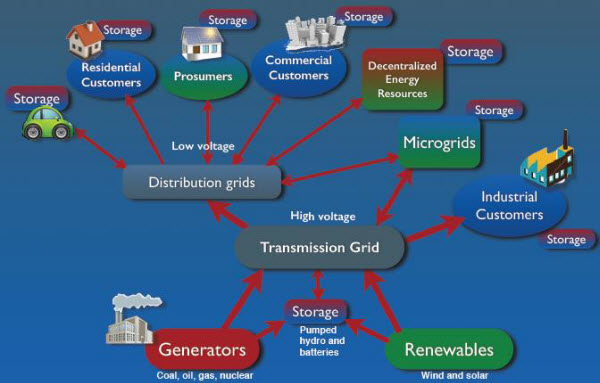

As the cost of self-generation, not just solar PVs, continues to drop and technologies to better manage demand, store energy and operate semi-independent micro-grids evolve, increasing number of consumers will take advantage of opportunities to generate, store and trade electrons, not just back and forth to the “utility” as is the case today, but to their neighbors across the street, or across the city, or state. Over time, flow patterns that used to be one-way and highly predictable will become complex and convoluted.

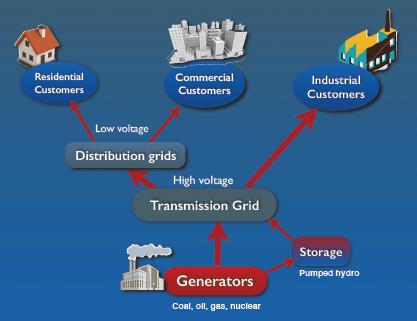

When generation was centralized & power flow one-way

Source: Transactive Energy, S. Barrager & E. Cazalet, on Apple iBooks, 2014

In this context, the fundamental role and function of the distribution network, and by extension transmission and central generation, will also change. The network, the grid, will evolve from a one-way conduit moving electrons from central plants to consumers will assume a much more complicated and valuable function, namely one of balancing prosumers’ variable load and generation while providing a myriad of important services including back-up, reliability and power quality.

As extensively covered in the June and Sept 2014 issues of EEnergy Informer, the regulators in California and New York have initiated two important investigations precisely because they have come to the conclusion, correctly, that the problem facing the industry they regulate is not limited to the treatment of solar vs. non-solar customers, or fixed vs. variable charges, or time-variable tariffs, or special tariffs for customers with or without EVs, or storage, or any combination of these.

Distributed generation & complicated power flows

Source: Transactive Energy, S. Barrager & E. Cazalet, on Apple iBooks, 2014

The problem lies in the fact that as more consumers become prosumers and/or invest in storage and home energy management (HEM) devices, the nature and definition of services they desire and are willing to pay for changes — just as happened with mobile telephony, digital cameras, or any other disruptive technologies.

Telephone consumers, who used to pay for the old land line service a per minute charge applied to the number of minutes, now essentially pay a fixed monthly charge based on the speed and bandwidth of the mobile network. Everybody pays for being connected to the ubiquitous network; those with the need for fast access to download and upload files and videos pay more for these valuable services. Customers sign long-term agreements, usually multiple years, for service with penalties for switching from one network to another.

Two kinds of transactions: Forward & Spot

Think transactive: tenders and transactions; “forward” and “spot”

Source: Transactive Energy, S. Barrager & E. Cazalet, on Apple iBooks, 2014

The mobile phone bills, if anyone can understand them, detail what transactions took place, basically when calls were made, for how long, and the volume of digital data that was uploaded or downloaded. Few people talk on the phone these days.

Many familiar with the changing nature of services on the electricity network believe that a similar transition will take place in the coming years, and the bills must also account for the transactions that the network enables or facilitates. These may include uploading electrons from the grid during evening or cloudy days, uploading into the grid during sunny hours of the day for those with PVs, and other transactions, say electrons stored in the EV battery, some of which may be sold back to the grid or another customer at times of high network prices.

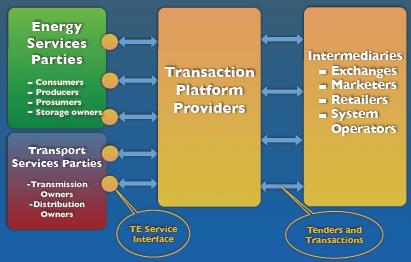

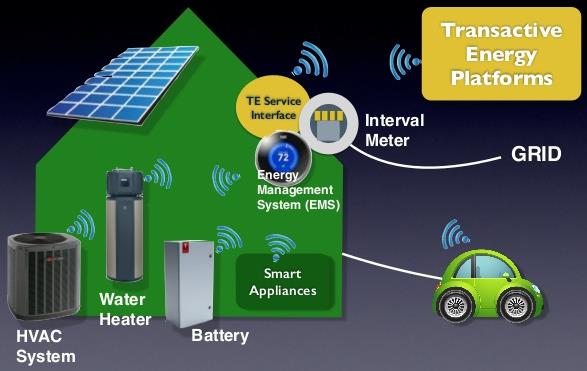

Transactive energy platform: Are you buying or selling?

Source: Transactive Energy, S. Barrager & E. Cazalet, on Apple iBooks, 2014

In Transactive Energy, a recently published eBook, Stephen Barrager and Edward Cazalet point out that, “The complexity of the electricity market is beginning to overwhelm regulators, planners and (grid) operators,” adding, “The struggle to integrate prosumers (mostly PV panel owners) into the grid is one indication of the challenges we are facing.”

Deciding how much to pay, or not to pay, for customer-installed solar PVs, the authors make clear, is not the end of the problem. If fixed monthly customers fees are raised or credit for excess solar generation is scaled back — proposals currently in vogue by the industry — disgruntled prosumers may be persuaded to install batteries and/or invest in EVs, to back up their solar generation, making matters worse.

Manageable but not trivial

All parties are brought together by Transaction Platform Providers

Source: Transactive Energy, S. Barrager & E. Cazalet, on Apple iBooks, 2014

“These issues are very difficult for our outdated command-and-control systems to sort out. The slow pace of dealing with change is stifling innovation,” the authors say, concluding, “Our electric utility and regulatory model is outdated and ill-equipped to deal with decentralized energy, prosumers, storage, and micro-grids.”

The solution? Transactive Energy (TE), using forward– and spot-priced tenders among producers and consumers. The authors envision the emergence of transactive energy platforms where buyers and sellers can trade.

As further described in the book,

“Producers signal to consumers that they have energy to sell by offering sell tenders. Consumers decide if they want to accept a portion of a sell tender at a tendered price, wait for a better tender, or not use as much energy.” “Producers, consumers, and prosumers can transact bilaterally or autonomously on the TE Platforms.”

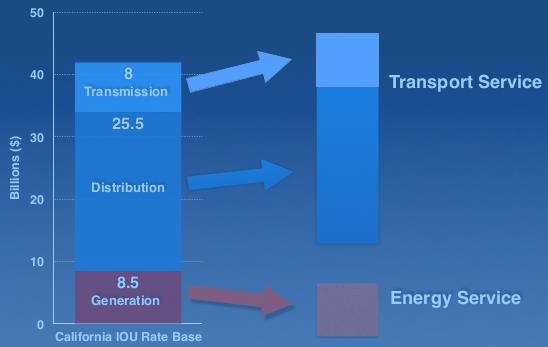

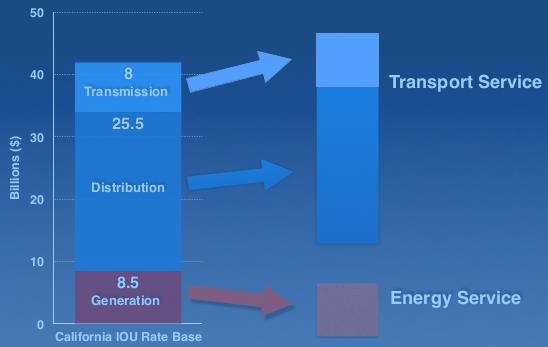

Utility business, like all network industries, is mostly fixed costs

Source: Transactive Energy, S. Barrager & E. Cazalet, on Apple iBooks, 2014

Other excerpts:

“There are 2 products: energy and transport service. Customers will transact for their energy needs and separately transact for transport.”

“Energy services parties and transport services parties meet on TE Platforms where they agree on transactions that may be facilitated by various intermediaries (schematically shown on page 5 and above).”

“There is one market rather than separate wholesale and retail markets as we have today. For each producer, intermediary, and transmission and distribution operator, there needs to be only one tariff for energy and one tariff for transport.”

“TE offers a vision that is efficient, fair, and transparent. Customers and producers, no matter what size, play by the same rules. Costs are allocated fairly by an open, commercial process. The whole system is operated on consistent and transparent principles.”

At least on paper, TE offers an elegant solution to many of the complexities of the evolving electricity market. When asked, about TE’s near term feasibility, Ed Cazalet told EEnergy Informer, “Transactive Energy is feasible in many places today, it is the natural next step in the evolution of the electricity business and regulatory model.” Cazalet’s description of TE may also be found in our book on Distributed Generation.

Co-author Steve Barrager, agrees, pointing out that, “We are about to see a welcome disruption in the electric utility business model. Technology is making it feasible for all customers and storage devices to have access to wholesale energy markets — differentiated by time and location. The technical disruptions will help us move toward a business and regulatory model that is more efficient, fairer, and more transparent. It will also spur innovation.”

Ready or not, prosumers are already transacting with other consumers via the grid

Source: Transactive Energy, S.Barrager & E. Cazalet, on Apple iBooks, 2014

TE has attracted many converts in recent years — mostly because they have come to the conclusion that incremental solutions such as shifting more costs to fixed monthly charges is not going to solve the fundamental problems plaguing the industry and its outdated revenue collection model. There is even an active Transactive Energy Association on LinkedIn, along with a website.

Still not convinced? Discussion topics on the TE website include the following:

- Introduction to transactive energy;

- Need and motivation for transactive energy;

- Transactive retail tariffs;

- Transactive energy for the end-to-end grid;

- Transactive subscriptions for T&D and fixed costs;

- Capacity markets and products;

- Reliability and control;

- Customer benefits;

- Demand response; and

- Business and regulatory models.

Clearly, TE converts have been doing their homework. It is a timely idea worth further examination.

Copies of the eBook by Barrager & Cazalet may be found on iTunes.